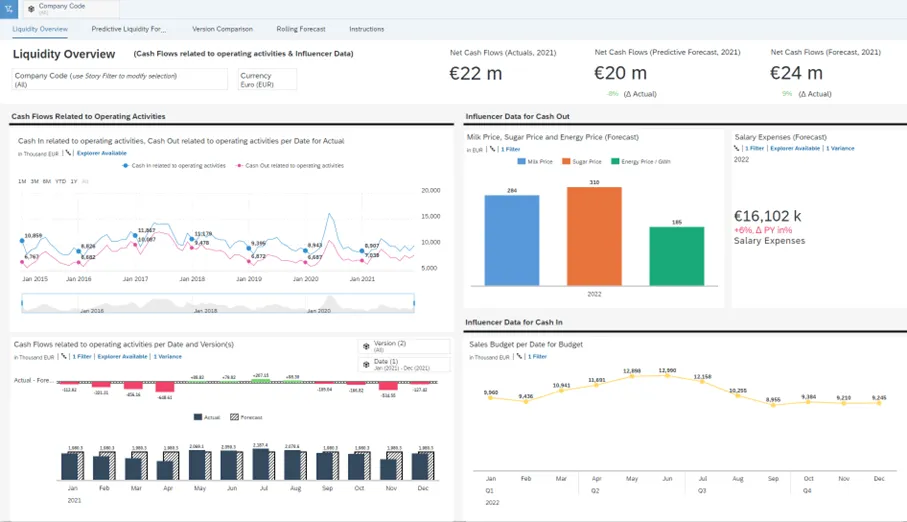

Plan future liquidity requirements with the SAP Analytics Cloud: Not only, but especially, in times of rising interest rates, material, energy and personnel costs, companies are increasingly faced with the question of whether sufficient liquid funds are always available for current expenses. Planned investments also require sufficient short-term liquidity to be able to pay invoices.

These considerations also include considerations of short- and medium-term investments and loans. In order to make the right decisions, data from the SAP system must be considered together with planned items such as short-term investments, credit lines or short-term loans. For this purpose, SAP provides a tool in the cloud: SAP Analytics Cloud (SAC for short).

SAC (SAP Analytics Cloud)

SAP Analytics Cloud’s liquidity planning feature allows plannning of future liquidity. For this purpose, a connection is established between SAP S/4HANA and SAP Analytics Cloud. This then enables to develop liquidity plans in SAP Analytics Cloud using the integrated data sources from SAP S/4HANA.

Data sources

The prerequisite for this is that all necessary settings have been made in the S/4 Finance system in order to generate a correct database.

This data is used to compare planned data with actual data. Named actual data includes:

- Information from Finance:

o Account balances

o Open receivables and payables

- Data from logistics:

o Goods that have been delivered but not yet invoiced

o Order commitment etc.

A new plan can then be created together with information outside of SAP.

Planning process in the SAC

In the SAC, planning files can be created and distributed in a top-down process. These are then consolidated in a bottom-up process and updated in several runs if necessary.

To do this, the group’s cash manager creates a first version, which is made available to the cash managers of the parts of the company. This initial information can be copied from the actual data of a period or the planned data of a previous version. It is also possible to create a new version manually. The cash managers of the individual companies check and supplement or update their data. When the data is ready, each company’s cash managers submit their results. The group’s cash manager summarizes the results and can send a notification to the employee in question if clarification is needed. This person in turn processes the request and sends the result.

The aforementioned coordination process is supported by a workflow so that users are informed in the SAP inbox as soon as new tasks need to be completed.

Once this coordination process is completed, a current version of the liquidity planning is provided.

Advantages SAC vs. FI-FSCM-CL

Liquidity planning with the SAP Analytics Cloud offers users the following advantages:

- Complete liquidity planning by using the existing data in the S/4HANA system

- No middleware or data warehouse required

- Accelerated implementation by using predefined models such as input templates, calculation schemes and planning process workflows

Do you have any questions about liquidity calculation? Simply write to sapberatung@inwerken.de Our accounting team will contact you! You can find additional services in our portfolio.